Stripe and PayPal are top eCommerce-focused online payment processors. By September 2020, PayPal and Stripe have 49.52% and 16.02% market shares in the e-payments business, respectively. They are the top two giants among international payment gateways, owning more than 60% of the market share in total.

PayPal is a well-known brand with services that are simple to use, while Stripe has very features dedicated to developers. For many Merchants, Stripe’s transaction fees are lower while for others, PayPal has lower fees overall. Both services support invoicing and recurring billing.

Let Global Link Asia Consulting help you take an in-depth look at these two payment gateways and advise you which one is better for your business.

1. PayPal/Stripe is popular among businesses worldwide

1.1 PayPal

Let’s talk about PayPal first. PayPal is an online payment service provider that handles money transfers and payment processing for online sellers, auction sites, and other business customers. PayPal was founded in 1998 and bought by eBay in 2002 before becoming a separate publicly traded corporation in July 2015. Since then, the firm has evolved to become one of the most frequently recognized digital payment systems among North American shops.

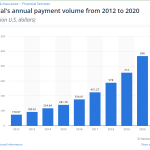

PayPal had an annual payment volume of over 712 billion US dollars in 2019, with cross-border transactions accounting for about a fifth of the total payment volume. With a net income of around 2.46 billion US dollars in 2019, the company’s yearly sales were approximately 17.77 billion US dollars. The vast bulk of the company’s revenue comes from transaction fees across all of its payment products, as well as other value-added services including credit loan interest and fees, subscription fees, and partnerships.

PayPal’s mobile app also offers mobile payment possibilities. In 2018, the company’s yearly mobile payment volume was 227 billion US dollars. In the United States, PayPal is presently one of the most popular mobile billing and top payment alternatives for online transactions.

1.2 Stripe

Next is Stripe. Stripe was founded in 2011 to provide payment processing software to internet companies. Stripe, which was once exclusively available in the United States, has expanded globally and now supports businesses in 46 countries. It took the firm less than three years after its public launch in September 2011 to reach a valuation of more than $1 billion. Today, the corporation is worth $94.4 billion.

According to BuiltWith statistics, 3,124,751 active websites accept Stripe payments on their websites. Stripe Checkout is utilized on 784,256 active websites. Stripe has a 15.49 percent market share in the payment processing category, according to Datanyze statistics, as measured by the number of websites that use the program.

According to CB Insights, payments conducted through Stripe will surpass $350 billion by 2020. When compared to an expected $150 billion in 2019, this is a 133% increase. In reality, Stripe’s payment volume increased at a compound annual growth rate of 104% between 2015 and 2020. And, over the last five years, Stripe’s payment processing volume has grown at a minimum of 50% every year, with the greatest pace of 150 percent in 2017.

2. Potential problems that PayPal and Stripe account holders may suffer

For all its popularity as a payment solution, PayPal and Stripe has little drawbacks. Like many payment processors, it has some cons that small business owners should consider before making it their primary online payment processor.

Here are some of the common issues that PayPal/Stripe may cause for your business:

- Some consumers have grown weary of PayPal/Stripe due to issues with illegal transactions and disputes. That means that customers may be reluctant to use PayPal when shopping on your site.

- PayPal’s and Stripe’s security can be a concern; if your account is hacked, the hacker could potentially send all your money to another account or make other unauthorized transactions. While their security is fairly strong, it’s not 100 percent safe.

- If you receive a chargeback, the funds are frozen until the dispute is resolved and you may need to pay a dispute fee.

- When you use a PayPal Business account, PayPal may apply a few Jumpstart Reservers, Rolling Reserves, and so on to your account. In this case, account holder must wait for 21, 45, or 60 days before the money becomes available. For Stripe, the reserve amounts are typically lower. However, Stripe accepts lower dispute rates and will close your account immediately if the dispute and chargeback rates become too high.

3. How Global Link Incorporation helps you to optimize the payment process for your business

New and innovative payment options are in high demand. Businesses are continually looking for ways to make things simpler for their consumers while causing the least amount of trouble. If you need a more flexible payment solution, then Global Link Incorporation is the best choice for you. We are proud to offer a wide range of payment solutions to fit your needs, following these steps:

-

Our expert team will analyze your company, your demands, and any issues you are having with your present payment options, based on your information, after reaching you via emails.

-

We will customize and advise on the best solutions to your problems. In this section, we will discuss which payment processor is best for your business strategy.

-

Furthermore, we advise you on how to sustainably manage your payment account through limitation avoidance, high reserve, and so on.